Other activities

As you know from previous conversations, appraisals are required by the lender to determine the value of their investment.

Sometimes sellers reach out to the appraisers prior to listing the property in order to price it right. Also, your agent will run CMA (this is not an official report that you can use for your mortgage) so that you have better understanding if the market and anticipating the outcome of appraisal.

You must be wondering what kind of magic an appraiser does to evaluate a home. Although the appraiser report may be up to 30 pages, it will be easier for you to understand once you know the ABC of the process.

Because no two parcels of real estate are exactly alike, each comparable property(properties that an appraiser use to compare) must be analyzed for differences and similarities between it and the subject property. The appraiser will consider below when comparing which adjustments must be made:

- Property rights. An adjustment must be made when less than the fee simple legal bundle of rights is involved. This includes land leases, ground rents, life estates, easements, deed restrictions, and encroachments.

- Financing concessions. The financing terms must be considered, including adjustments for differences such as mortgage loan terms and owner financing or buydowns by a builder-developer.

- Market conditions. Interest rates, supply and demand, and other economic indicators must be analyzed.

- Conditions of sale. Adjustments must be made for motivational factors that would affect the sale, such as foreclosure, a sale between family members, or some nonmonetary incentive.

- Market conditions since the date of sale. An adjustment must be made if economic changes occur between the date of sale of the comparable property and the date of the appraisal.

- Location, or area preference. Similar properties might differ in price from neighborhood to neighborhood or even between locations within the same neighborhood.

- Physical features and amenities. Physical features such as the building’s age, size, and condition may require adjustments.

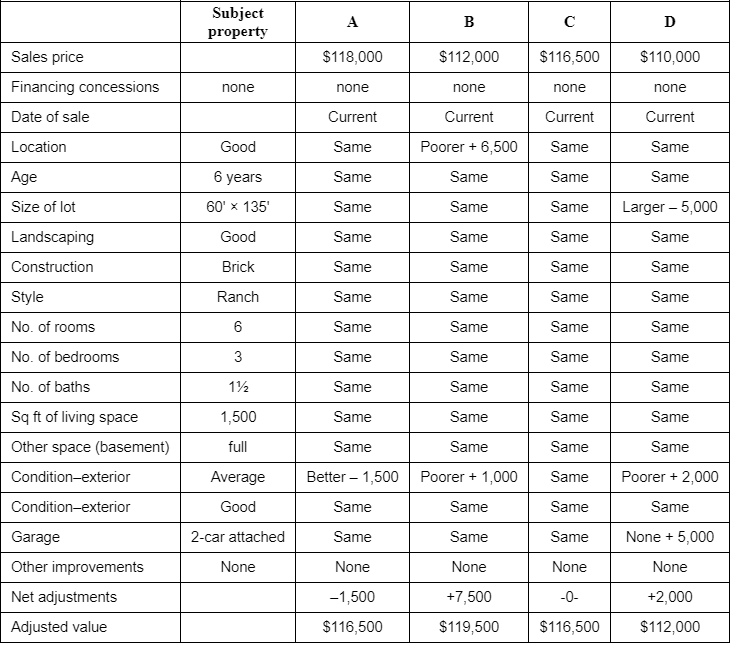

Most appraisals include a minimum of three comparable sales reflective of the subject property. Here is a visual for comparison:

Underwriting is the process of analyzing the extent of risk a lender will assume in connection with a mortgage loan. In addition to assessing the value of the collateral being pledged for the loan, the lender evaluates the capacity and credit-worthiness of the borrower based on the following criteria:

- Occupancy. Lenders reserve the best rates for owners who occupy the property.

- Income. Lenders apply ratios to determine that the borrowers have enough income to support themselves and repay normal household expenses while making their mortgage payments.

- Assets and cash reserves. Lenders scrutinize existing bank accounts, often asking for verification of funds. The borrowers must be able to account for the money in the account as being theirs and not from someone else expecting repayment.

- Debt. Ideally, lenders prefer that housing payments (PITI) and association fees be less than 28%of gross income and, when combined with other debts longer than 10 months or so, is less than 36%of gross income.

- Loan-to-value (LTV). The loan-to-value (LTV) ratio is the ratio of the debt to the sale price or appraised value, whichever is less. The greater the borrower’s stake in the collateral, the lower the lender’s risk. If the down payment is less than 20%, lenders frequently require some insurance to cover deficiencies in case of default.

Lenders commonly use risk-based pricing—the interest rate or other terms reflect the lender’s assessment of the risk associated with the loan. They often rely on automated scoring systems as part of their underwriting process. Automated scoring should provide an objective standard against which to balance the more subjective, professional judgment of a loan officer. Several commonly used automated systems are Freddie Mac’s Loan Prospector and Fannie Mae’s Desktop Underwriter. Automated scoring can shorten the loan approval time and may lower the cost of processing and approving loan applications.

You are so near to close the deal however there is one more player you’ll need to meet: title companies. The role of a title company is to confirm that the title to the real estate is lawfully given to you. Fundamentally, they make sure that the seller has the rights to convey the property.

Normally, a title is not ordered until major contingencies in the agreement of sale have been cleared, such as mortgage contingency. However keep in mind, before providing money for a loan, a lender generally requires ascertain the condition of the title and ensure that there are no liens superior to the one the lender will file.

On the other hand, you need to be sure that the seller can convey title to the property. If the property is subject to any liens or other encumbrances, a prospective buyer or lender needs to know. An attorney or title company typically performs a search of the public records to ensure that good title is being conveyed.

In order to confirm that the title is legit, the title company will run a title search. Title search is an examination of all public records to determine whether any defects exist in the chain of title. The records of conveyances of ownership are examined, beginning with the present owner. Then the title is traced back to its origin (40 to 60 years or some definite period of time, depending on state statute).

Other public records are examined to identify wills, judicial proceedings, and other encumbrances that may affect title. These include a variety of taxes, special assessments, and other recorded liens.

An abstract of title is a summary report of what the title search found in the public record. The abstractor (person who prepares the report) searches all the public records and then summarizes the various events and proceedings that affected the title throughout its history. The report begins with the original grant (or root) and then provides a chronological list of recorded instruments.

All recorded liens and encumbrances are included, along with their current status. A list of all of the public records examined is also provided as evidence of the scope of the search. The report does not reveal such items as encroachments or forgeries or any interests or conveyances that have not been recorded.

After examining the abstract, an attorney prepares a written report about the condition of the ownership. This report is called an attorney’s opinion of title.

Under the terms of the typical real estate agreement of sale, the seller is required to deliver marketable title to you at the closing. To be marketable, a title must:

- disclose no serious defects and not depend on doubtful questions of law or fact to prove its validity;

- not expose a purchaser to the hazard of litigation or threaten the quiet enjoyment of the property;

- convince a reasonably well-informed and prudent person, acting on business principles and with knowledge of the facts and their legal significance, that she could sell or mortgage the property at a later time; and

- be insurable by a reputable title insurance company at ordinary rates.

Although a title that does not meet these requirements still could be transferred, it contains certain defects that may limit or restrict its ownership. You cannot be forced to accept a conveyance that is materially different from the one bargained for in the sales contract.

However, questions of marketable title must be raised by you (or the your attorney) before acceptance of the deed. Once a buyer has accepted a deed with unmarketable title, the only available legal recourse is to sue the seller under any covenants of warranty contained in the deed.

Once title company decides that the title is marketable, they protect you from an event that occurred before by granting an insurance. Title insurance is a contract under which the policyholder is protected from losses arising from defects in the title.

A title insurance company determines whether the title is insurable, based on a reviews mentioned earlier. Unlike other insurance policies that insure against future losses, title insurance protects the insured from an event that occurred before the policy was issued.

Title insurance is considered the best defense of title. The title insurance company will defend any lawsuit based on an insurable defect and pay claims if the title proves to be defective.